CONSUMER SECTOR

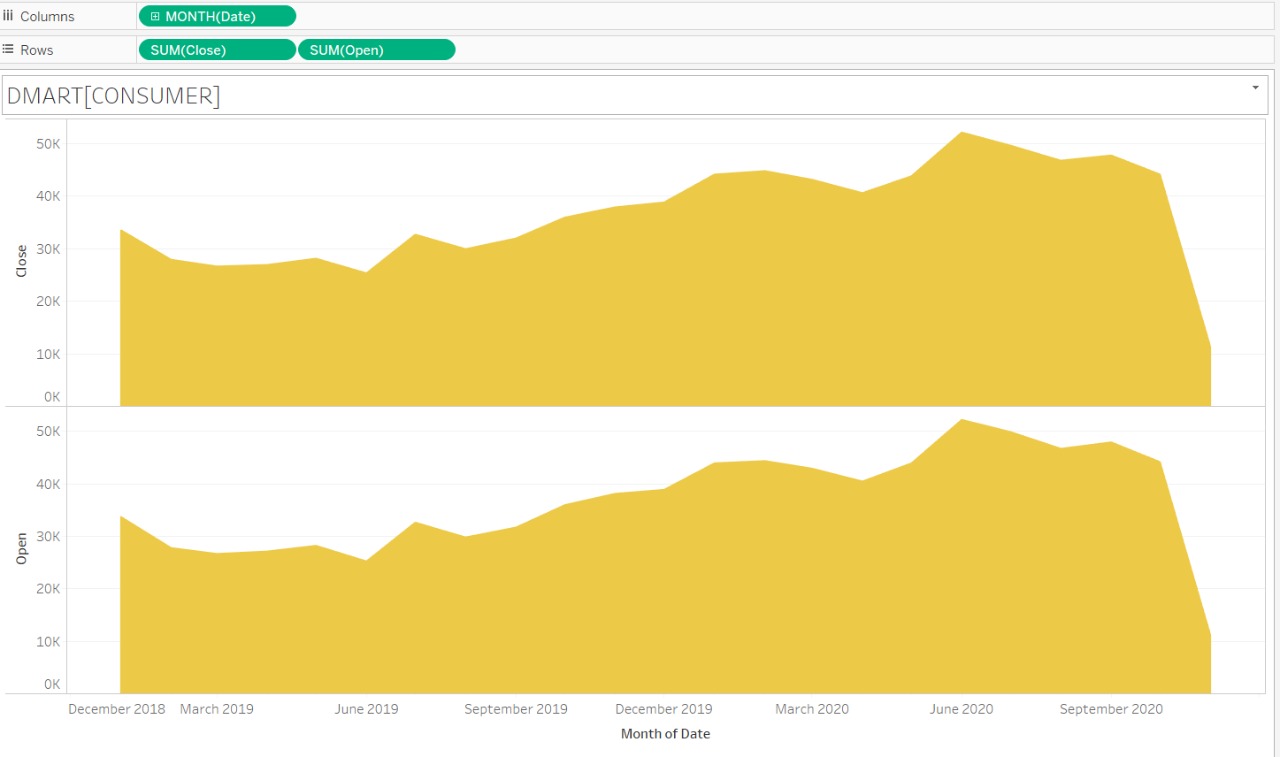

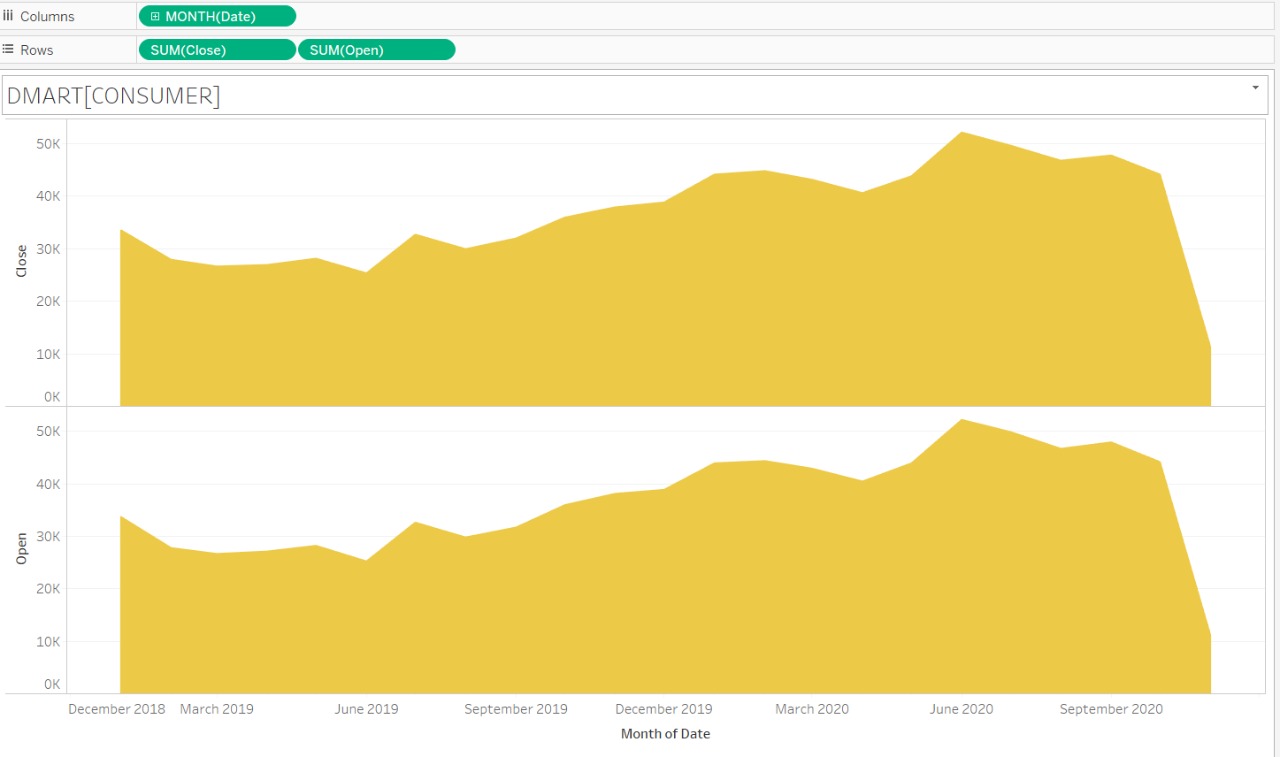

1.DMART

DMart in the March quarter showed the full impact of COVID-19 with lower footfalls, higher cost of operations

and restrictions on the sale of non-essentials. Total income of Smart dropped 12% on-year to Rs. 5274 crore

The slip in profits was due to lower store footfall and repeated lockdowns across the country.

Although the management highlighted that the festive season would help restore demand, it warned of supply-side challenges.

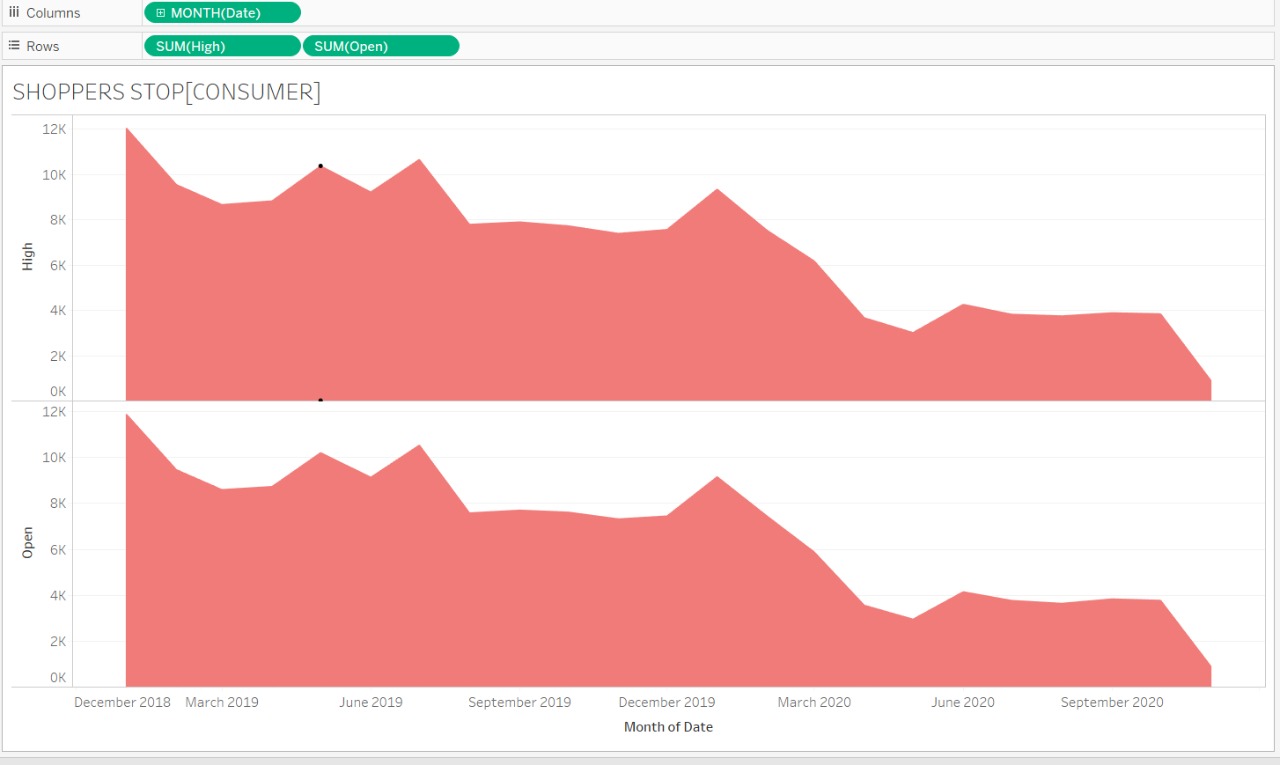

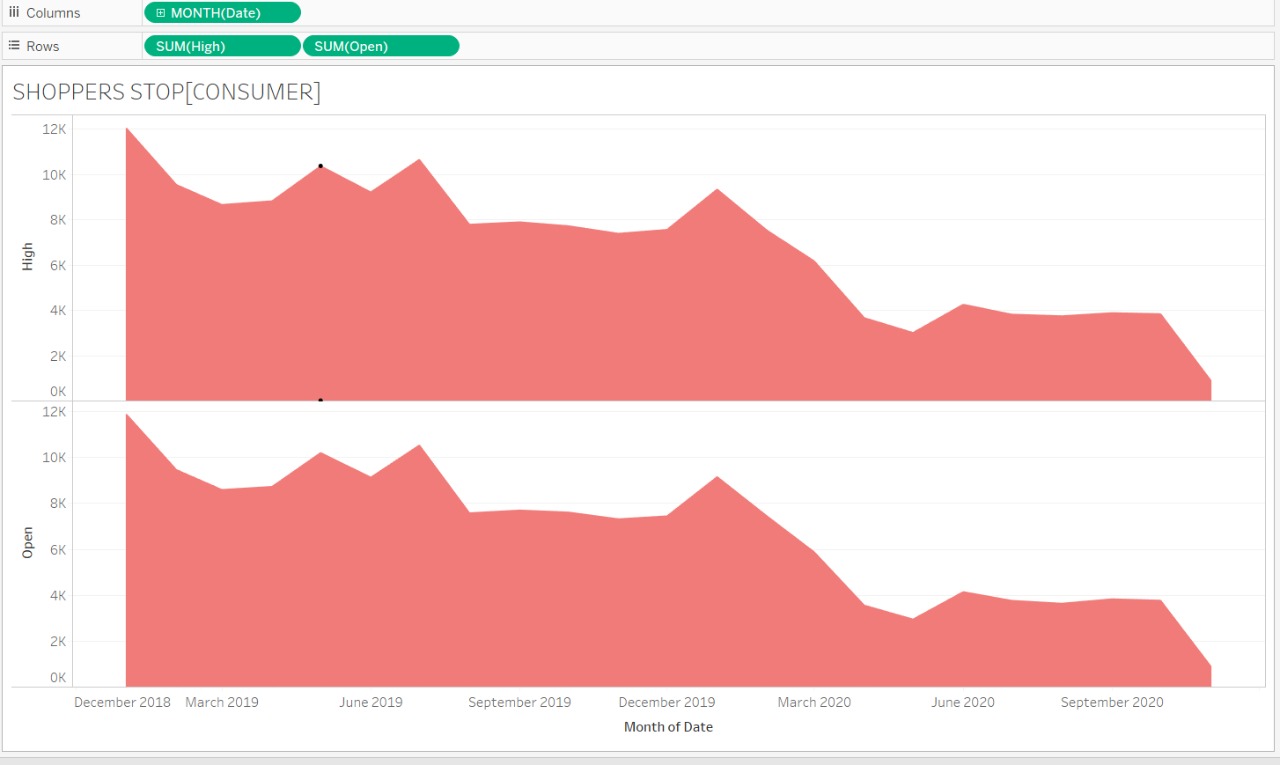

2.SHOPPER STOP

This lifestyle retailer has been struggling for many quarters, but the past two have been particularly bad. Loss has mounted on negligible sales amid lockdowns.

The company’s performance has been bad compared with its listed peers, because its business model is based on the departmental store chain format, and online presence is weak.

They have projected up to price targets that suggest nearly 40 per cent upside over the next 12 months over.

From Jan 2020 due to covid impact, price started falling rapidly but it started rising gradually and remain constant during unlock period.